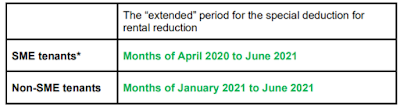

Prior to the PERMAI announcement, a special tax deduction is given to landlord taxpayer who provides a reduction in rental of business premises to SME tenants of at least 30% from the original rental rate from 1 April 2020 to 31 March 2021. Under the PERMAI announcement, this special deduction was expanded to cover rental reduction given to non-SMEs; and the special deduction period was also extended until 30 June 2021. The said revised FAQ seeks to provide further clarification on the above special tax deduction on rental reduction arising from the related PERMAI announcement. Below are the salient updates from the revised FAQ:-

Monday, 8 March 2021

Special Tax Deduction for Rental Reduction for Business Premises

* For the purposes of this special deduction, the SME tenant must be a registered SME

and obtained SME Status Certificate from the SME Corporation Malaysia. SME Status

Certificate issued until 30 June 2021 can be used as verification for the said SME

status.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment